Combined to Serve You Better

Wakefield Cooperative Bank is now part of Reading Cooperative Bank.

LATEST UPDATES

Expanded ATM Network Available

We're pleased to announce that all Wakefield Cooperative Bank ATMs have been added to our network....

Expanded ATM Network Available

We're pleased to announce that all Wakefield Cooperative Bank ATMs have been added to our network....

Expanded ATM Network Available

We're pleased to announce that all Wakefield Cooperative Bank ATMs have been added to our network....

The Transition is Complete!

Questions? We're here to help!

What's Changed

- All branches are now offering customers access to all banking services.

- To bank by mail, please send any deposits or transactions to Reading Cooperative Bank, P.O. Box 330, Reading, MA 01867.

- For telephone banking, dial 888.469.4441. Your temporary PIN will be the last four digits of your Social Security number or Tax ID. For businesses, your temporary PIN will be the last five digits of your Social Security Number.

- Access online banking with your existing credentials by logging in through RCB.

- For mobile banking, all customers must use the Reading Cooperative Bank Mobile App. Please delete the Wakefield Cooperative Bank app from your device if you have not already.

- Any previous settings used by Wakefield customers for online and mobile banking or debit cards can now be updated through RCB's systems.

- While Wakefield's routing number will remain valid indefinitely, update your direct deposit and electronic payments with the new routing number: 211372404 to ensure uninterrupted service.

- Payments for Mortgage, Commercial Loan, and Line of Credit Customers will be accepted at any location, but it is recommended to update the mailing address to Reading Cooperative Bank, 180 Haven Street, Reading, MA 01867.

- New debit cards issued to previous Wakefield customers are now fully operational.

- The daily withdrawal limit at all ATMs is now $1000.

- Debit card purchases now have an increased daily limit of $3000.

- Any previous settings used by Wakefield customers debit cards can now be updated through RCB's systems.

Some previous Wakefield account names have been changed to align with RCB's naming system.

Consumer Checking Accounts

| This WCB product... | becomes this RCB product |

|---|---|

| Free Checking | Value Checking |

| Regular Now Checking | Value Now Checking |

| Advanced Premier Checking | Value Now Checking |

Savings & Money Market Accounts

| This WCB product... | becomes this RCB product |

|---|---|

| Money Market | Money Market Deposit Account |

| Ultra Money Market | Money Market Deposit Account |

| Platinum MMDA | Money Market Deposit Account |

| IRA Passbook Savings | IRA Statement Savings |

Business Checking Accounts

| This WCB product... | becomes this RCB product |

|---|---|

| IOLTA | IOLTA Checking |

| Small Business Checking | Easy Business Checking |

| Commercial Checking | Enterprise Checking |

The following account names will not change:

- Premier Rewards Checking

- Premier Checking

- Freedom Checking

- Premier Cash Back Checking

- Ultimate Plus MMDA

- All Time Deposit Product

- Zelle has been deactivated.

- Privilege Overdraft Protection is no longer available.

- Individual Retirement Accounts (IRAs) will be transitioned to RCB with an annual fee of $10 charged in December.

- You can expect to receive your tax documents from RCB for the tax year ending December 31st, 2025.

- If you are aged 73 or older, you can take the remainder of your required minimum distribution at RCB.

- If you have not yet fulfilled your required minimum distribution of 2025, please call 781.942.5000.

Shared Vision, Shared Values

Built on the same beliefs, structure, and even the same internal technology, our two organizations can start working together faster while delivering a smooth transition for our customers. And with so much in common, Reading and Wakefield Cooperative Banks are a natural fit.

Cooperative Mission

As customer-owned banks, our structure, mission, and outlook are inherently aligned.

Growing Together

Our banks' mutual goals focus on expanding our services to continuously meet customer needs.

Community Partners

Through our expanded branch network, we can strengthen our commitment to the North Shore community.

OUR EXPANDED NETWORK

Reading Cooperative Bank and Wakefield Cooperative Bank are combining to better serve you.

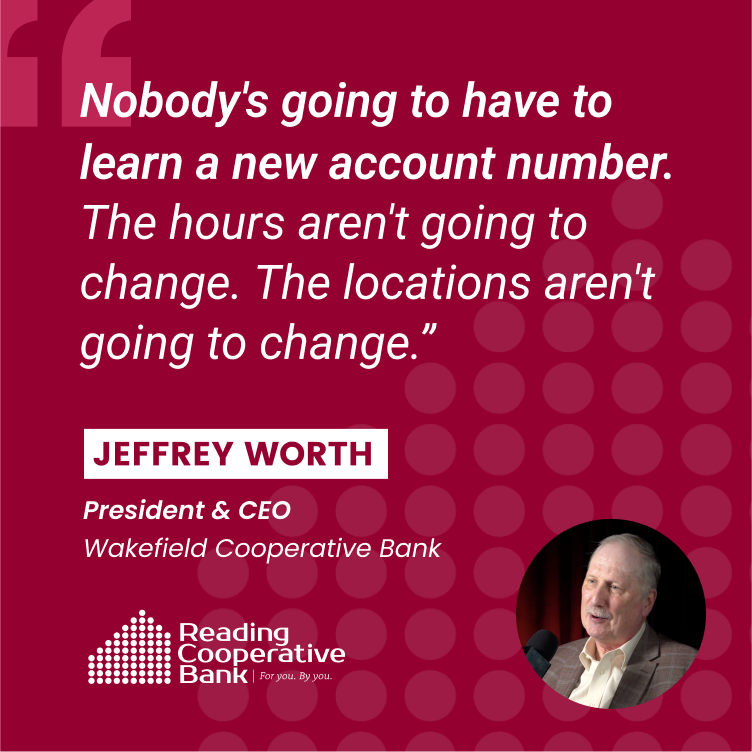

Under the Reading Cooperative Bank name, Reading Cooperative Bank's current President and CEO Julieann M. Thurlow will lead the organization, with Wakefield Cooperative Bank President and CEO Jeffrey A. Worth joining as President.